As someone working in the domain of conversational speech and language AI for over 25 years, from researching speech recognition in smart meeting rooms through to developing commercial products and services, it’s been an incredible journey seeing the technology evolve.

Along the way, I’ve learned that while we often focus on new technological capabilities, real value is only unlocked when we deliver that within a user experience that helps people achieve the actual job that they need to do, or the problem that a business needs to solve.

Another key learning has been that, while technology changes at a rapid pace, the millions of meetings and business calls taking place around the world each day are just conversations between people, and the fundamental nature of conversations never changes.

Conversations are dynamic interactions that unfold naturally, and so at first glance transcripts lack the readability and structure of authored text documents. There is, however, an organic structure to all conversations. They are set within a context, involving people with roles interacting in speaking turns similar to paragraphs in a document. Like chapters in a book, conversations progress through high-level discussion threads or topics, whether imposed by an agenda, or emerging naturally.

Ultimately, meaningful conversations include key passages worth highlighting – Moments of significance. Which specific Moments are significant depends on the context of the conversation. It could be someone saying they will follow up on an item tomorrow, or raising dissatisfaction with a product.

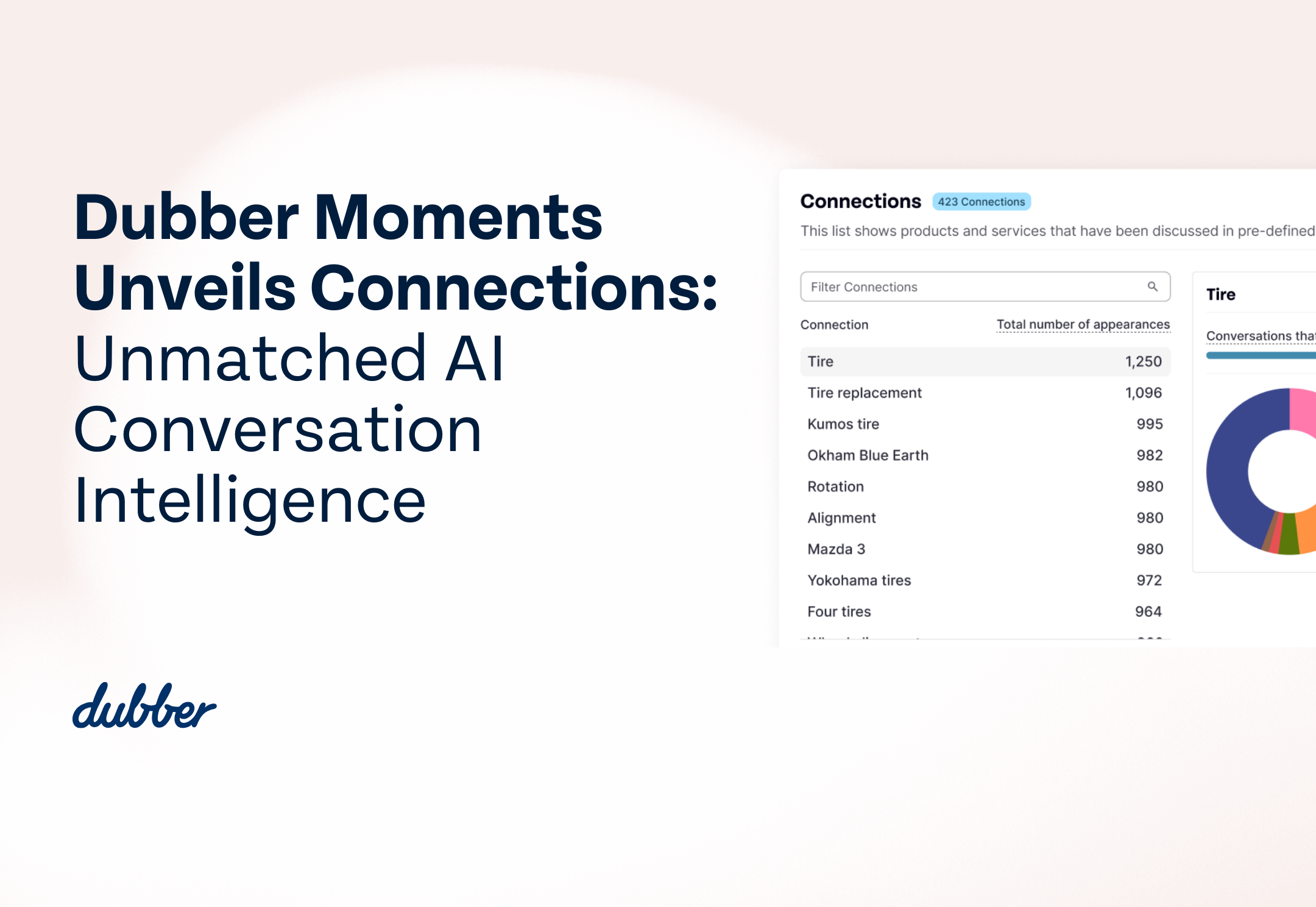

This perspective led us to develop Moments as a powerful way to deliver practical insights from business conversations. As our first Moment, we found Complaints have significance to a range of organisations seeking to improve how they serve their customers. Other Moments are in the pipeline – such as one that detects when staff suffer verbal abuse on a call, helping businesses provide a safer working environment.

The public awareness of AI skyrocketed with the launch of Chat GPT and now AI is everywhere. These technologies have, however, been steadily evolving over a long period of time. The Transformer neural network architecture underlying current language models was proposed back in 2017, and models have been steadily growing in capacity since then. Another big step forward in this field was around 2018 when automatic speech-to-text reached human-level accuracy at transcribing conversations.

While these things have been brewing for many years, there is no question that in recent months we have witnessed an enormous step forward in the capabilities of Large Language Models. For me, the biggest change has been the naturalness of the responses these models generate to a broad array of questions or prompts, across industries and languages. From our perspective, what this means is that we can now distil long call transcripts into readable summaries and key points just like notes a person might have taken. For an end user this is a game changer – let’s face it, someone rarely has time to read a full transcript, they are mostly interested in just a few key moments.

In my role it’s important to stay at the forefront of this ever-evolving landscape. One way we do this is by fostering strong relationships with key technology partners and university research groups. This helps us see ahead to what is coming in the near-term as well as over the horizon. This highlights one of the benefits that customers gain from our cloud-based product – we seamlessly deliver the most up to date in AI technology for them to tap into. For them, it’s out of the box and scalable, without requiring them to invest in people, development or budget to implement, maintain or upgrade.

So while much of the world woke up to AI when Chat GPT was released, our conversation intelligence platform has been in development at Dubber for some time – particularly over the two years since acquiring Notiv. This platform allows us to deliver cloud-based AI-powered product experiences in a flexible, responsible way. This has positioned us to quickly launch the Moments product on a global scale through Service Providers.

Having done the heavy lifting, we’re now in the process of developing and rolling out a range of new Moments. How do we do this? We start with market research to define a Moment with value across a broad set of companies. We then collaborate closely with early adopter customers to evaluate and refine the Moment on their calls, validating the benefit to their business. An initial customer took 40,000 of their calls through this process, and for the first time they could see what people were complaining about, both at a macro level as well as being able to drill down into a specific conversation, helping them improve their customer experience and business performance.

Who do these use cases apply to? I honestly think the answer is ‘every business’. From a small business, to mid-size, up to enterprise, every company wants to hear directly from their customers to improve their business.

Technology evolves, but humans will always communicate through natural language. With Dubber in the network we can help service providers and their customers unlock the full value of their conversations. The use cases for ‘Moments’ are seemingly endless. Personally, my favourite moment is seeing one of our customers gain a new insight into their business and then realise that it was hiding in their call data all this time, just waiting to be uncovered!